We expose the exact steps tax pros use to reduce IRS debt, remove penalties, and file back taxes smart — so you can do it yourself, for free.

4.7 on review

4.7 on review

Book a free appointment with our experts, trained by top tax professionals and attorneys, to address a wide range of tax challenges. Whether you're a small business owner, freelancer, or seeking guidance, we’ll listen to your concerns and provide personalized relief solutions—all at no cost.

What You’ll Get with Back Taxes Advocate

Discover hidden IRS strategies and lesser-known provisions that can significantly reduce your tax burden or resolve debt issues.

Get clear, actionable instructions to negotiate settlements or temporarily pause IRS debt collection efforts with confidence.

Stay informed about the latest IRS collection methods and enforcement strategies to protect yourself from unexpected actions.

Learn from real-life examples of individuals who saved $50,000 or more by applying our proven tax relief strategies.

Receive timely updates on IRS policies and new tax laws to ensure you’re always prepared and compliant.

Maximize your savings with tailored deduction strategies specific to your job or business, ensuring you keep more of your income.

Learn how to eliminate IRS penalties using the correct forms and procedures, saving you thousands in unnecessary fees.

Identify and steer clear of common mistakes that trigger IRS audits, protecting you from costly scrutiny.

Use advanced filing techniques to minimize your tax liability and optimize your returns legally and effectively.

Access proven scripts to communicate effectively with the IRS, ensuring clarity and professionalism in every interaction.

How to Book Your Tax Relief Appointment

Schedule an appointment today, and our experts will provide personalized tax relief solutions tailored to your needs.

Meet with our experts to get tailored solutions for your tax needs. Schedule an appointment today, and let us guide you every step of the way.

Schedule an appointment to meet with us, and we’ll craft a customized plan to address your tax challenges.

Book a meeting, and we’ll review your tax documents together, ensuring everything is in order for relief or compliance.

Set an appointment to discuss your IRS issues, and we’ll guide you through the best ways to negotiate and resolve them.

Make an appointment for a private meeting where we provide expert advice tailored to your unique tax situation.

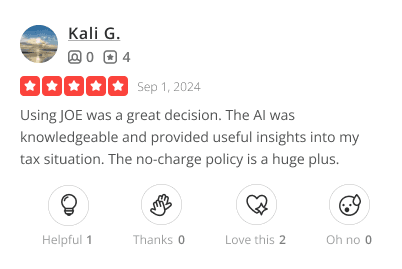

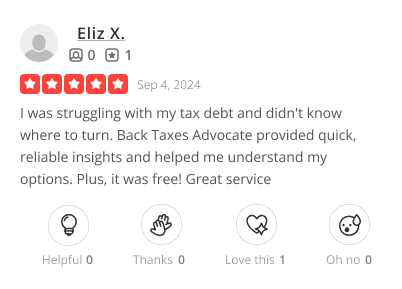

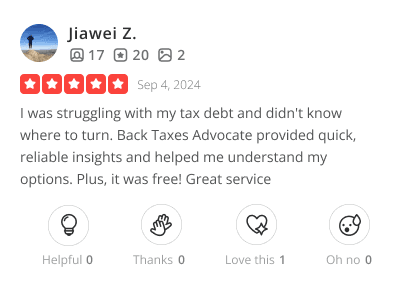

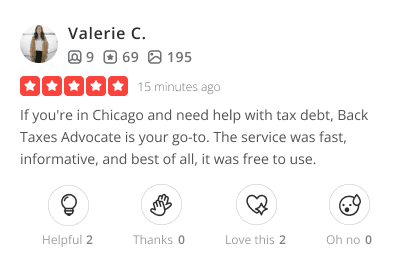

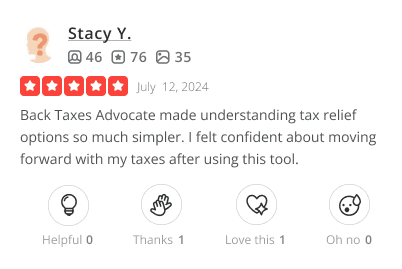

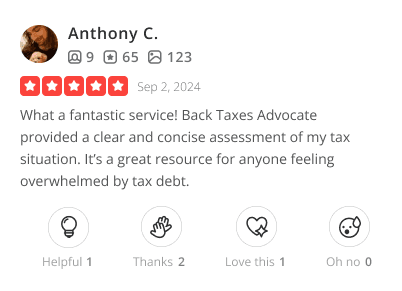

See how Back Taxes Advocate has helped people just like you find tax relief and peace of mind. Thousands of users have discovered new options for managing their taxes and easing financial stress—all at no cost. Join our community and experience tax relief made simple.

Questions about booking your tax relief appointment

Subscribe to our free newsletter and discover the exact steps tax pros use to reduce IRS debt, remove penalties, and file back taxes smart — all delivered to your inbox. Book a free appointment for personalized guidance to tackle your tax challenges.